#!/usr/bin/perl

# In the sample code, the ChartDirector for Perl module is assumed to be in "../lib"

use File::Basename;

use lib (dirname($0)."/../lib") =~ /(.*)/;

use FinanceChart;

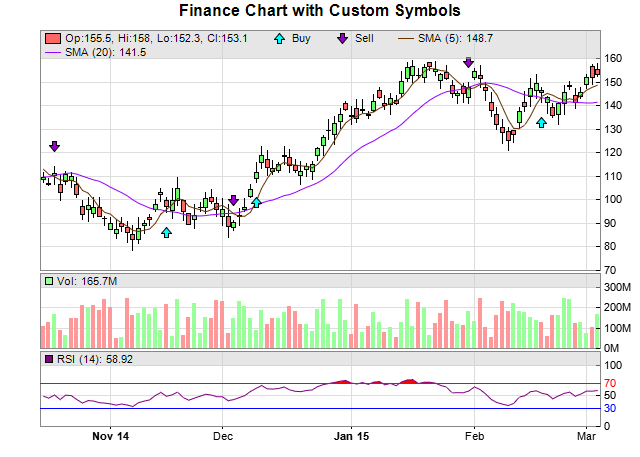

# Create a finance chart demo containing 100 days of data

my $noOfDays = 100;

# To compute moving averages starting from the first day, we need to get extra data points before

# the first day

my $extraDays = 30;

# In this exammple, we use a random number generator utility to simulate the data. We set up the

# random table to create 6 cols x (noOfDays + extraDays) rows, using 9 as the seed.

my $rantable = new RanTable(9, 6, $noOfDays + $extraDays);

# Set the 1st col to be the timeStamp, starting from Sep 4, 2014, with each row representing one

# day, and counting week days only (jump over Sat and Sun)

$rantable->setDateCol(0, perlchartdir::chartTime(2014, 9, 4), 86400, 1);

# Set the 2nd, 3rd, 4th and 5th columns to be high, low, open and close data. The open value starts

# from 100, and the daily change is random from -5 to 5.

$rantable->setHLOCCols(1, 100, -5, 5);

# Set the 6th column as the vol data from 5 to 25 million

$rantable->setCol(5, 50000000, 250000000);

# Now we read the data from the table into arrays

my $timeStamps = $rantable->getCol(0);

my $highData = $rantable->getCol(1);

my $lowData = $rantable->getCol(2);

my $openData = $rantable->getCol(3);

my $closeData = $rantable->getCol(4);

my $volData = $rantable->getCol(5);

# Custom data series should be of the same length as the OHLC data series

my $buySignal = [(0) x scalar(@$closeData)];

my $sellSignal = [(0) x scalar(@$closeData)];

#

# The following is just an arbitrary algorithm to create some meaningless buySignal and sellSignal.

# They are just for demonstrating the charting engine. Please do not use them for actual trading.

#

my $sma5 = new ArrayMath($closeData)->movAvg(5)->result();

my $sma20 = new ArrayMath($closeData)->movAvg(20)->result();

for(my $i = 0; $i < scalar(@$sma5); ++$i) {

$buySignal->[$i] = $perlchartdir::NoValue;

$sellSignal->[$i] = $perlchartdir::NoValue;

if ($i > 0) {

if (($sma5->[$i - 1] <= $sma20->[$i - 1]) && ($sma5->[$i] > $sma20->[$i])) {

$buySignal->[$i] = $lowData->[$i];

}

if (($sma5->[$i - 1] >= $sma20->[$i - 1]) && ($sma5->[$i] < $sma20->[$i])) {

$sellSignal->[$i] = $highData->[$i];

}

}

}

# Create a FinanceChart object of width 640 pixels

my $c = new FinanceChart(640);

# Add a title to the chart

$c->addTitle("Finance Chart with Custom Symbols");

# Set the data into the finance chart object

$c->setData($timeStamps, $highData, $lowData, $openData, $closeData, $volData, $extraDays);

# Add the main chart with 240 pixels in height

my $mainChart = $c->addMainChart(240);

# Add buy signal symbols to the main chart, using cyan (0x00ffff) upward pointing arrows as symbols

my $buyLayer = $mainChart->addScatterLayer(undef, $buySignal, "Buy", perlchartdir::ArrowShape(0, 1,

0.4, 0.4), 11, 0x00ffff);

# Shift the symbol lower by 20 pixels

$buyLayer->getDataSet(0)->setSymbolOffset(0, 20);

# Add sell signal symbols to the main chart, using purple (0x9900cc) downward pointing arrows as

# symbols

my $sellLayer = $mainChart->addScatterLayer(undef, $sellSignal, "Sell", perlchartdir::ArrowShape(

180, 1, 0.4, 0.4), 11, 0x9900cc);

# Shift the symbol higher by 20 pixels

$sellLayer->getDataSet(0)->setSymbolOffset(0, -20);

# Add a 5 period simple moving average to the main chart, using brown color

$c->addSimpleMovingAvg(5, 0x663300);

# Add a 20 period simple moving average to the main chart, using purple color

$c->addSimpleMovingAvg(20, 0x9900ff);

# Add candlestick symbols to the main chart, using green/red for up/down days

$c->addCandleStick(0x66ff66, 0xff6666);

# Add a volume indicator chart (75 pixels high) after the main chart, using green/red/grey for

# up/down/flat days

$c->addVolIndicator(75, 0x99ff99, 0xff9999, 0x808080);

# Append a 14-days RSI indicator chart (75 pixels high) after the main chart. The main RSI line is

# purple (800080). Set threshold region to +/- 20 (that is, RSI = 50 +/- 25). The upper/lower

# threshold regions will be filled with red (ff0000)/blue (0000ff).

$c->addRSI(75, 14, 0x800080, 20, 0xff0000, 0x0000ff);

# Output the chart

$c->makeChart("financesymbols.png") |